Payroll Services Made Easy: A Guide for Small Businesses

Introduction

Managing payroll can be one of the most complex and time-consuming tasks for small business owners. From calculating wages to withholding taxes, ensuring compliance with labor laws, and managing employee benefits, payroll involves numerous intricate details. However, with the right strategies and tools, payroll services can be simplified, allowing small businesses to focus on growth and profitability rather than administrative burdens. This guide aims to provide small business owners with a comprehensive understanding of payroll services, their benefits, and how to choose the right solution for their needs.

Understanding Payroll Services

Payroll services encompass a wide range of tasks related to compensating employees for their work. This includes calculating salaries, processing payments, managing tax withholdings, and ensuring compliance with federal and state regulations. Businesses can either manage payroll in-house or outsource it to a payroll service provider. Understanding the differences can help small business owners make informed decisions about which route to take.

In-House Payroll vs. Outsourced Payroll Services

When it comes to payroll management, there are two primary options: handling it in-house or outsourcing to a payroll service provider. Each choice has its advantages and disadvantages.

In-House Payroll

Managing payroll internally allows business owners to maintain complete control over the process. This can be beneficial for organizations with unique payroll needs or those that prefer direct oversight. However, in-house payroll requires significant time and resources. Business owners must stay updated on tax laws and regulations, which can change frequently. Additionally, mistakes in payroll processing can lead to costly penalties and employee dissatisfaction.

Outsourced Payroll Services

Outsourcing payroll services can alleviate the burden of payroll management. Payroll service providers specialize in handling payroll tasks, ensuring compliance with regulations and minimizing errors. These services often include additional features such as tax filing, direct deposit options, and employee self-service portals. While outsourcing incurs additional costs, many small businesses find that the time saved and the reduced risk of errors outweigh these expenses.

Benefits of Payroll Services for Small Businesses

Utilizing payroll services can provide numerous benefits for small businesses, including:

1. Time Savings

Payroll processing can be time-consuming, especially for small business owners who juggle multiple responsibilities. By outsourcing payroll, business owners can free up valuable time that can be spent on core business activities, such as marketing, sales, and customer service.

2. Reduced Risk of Errors

Payroll mistakes can lead to serious consequences, including fines, penalties, and employee dissatisfaction. Payroll service providers are equipped with the knowledge and tools to minimize errors, ensuring that employees are paid accurately and on time. This reduces the risk of costly mistakes that can harm a business's reputation and finances.

3. Compliance with Regulations

Payroll laws and regulations are constantly changing, making it challenging for small business owners to stay compliant. Payroll service providers keep up-to-date with these changes, ensuring that businesses adhere to federal, state, and local regulations. This reduces the risk of audits and penalties, providing peace of mind for business owners.

4. Enhanced Employee Satisfaction

Timely and accurate payroll processing contributes to employee satisfaction. When employees are confident that they will receive their paychecks correctly and on time, they are more likely to be engaged and productive. Payroll services often offer additional features such as online pay stubs and direct deposit options, enhancing the overall employee experience.

5. Access to Expertise

Payroll service providers employ experts who specialize in payroll management and tax compliance. Small businesses can benefit from this expertise without needing to hire a full-time payroll specialist. This access to knowledge can help businesses navigate complex payroll issues and make informed decisions regarding employee compensation and benefits.

Choosing the Right Payroll Service Provider

With numerous payroll service providers available, selecting the right one for your small business can be daunting. Here are some key factors to consider when making your choice:

1. Services Offered

Different payroll service providers offer varying levels of service. Some may only process payroll, while others provide comprehensive HR services, tax filing, and employee benefits management. Assess your business's specific needs and look for a provider that aligns with those requirements.

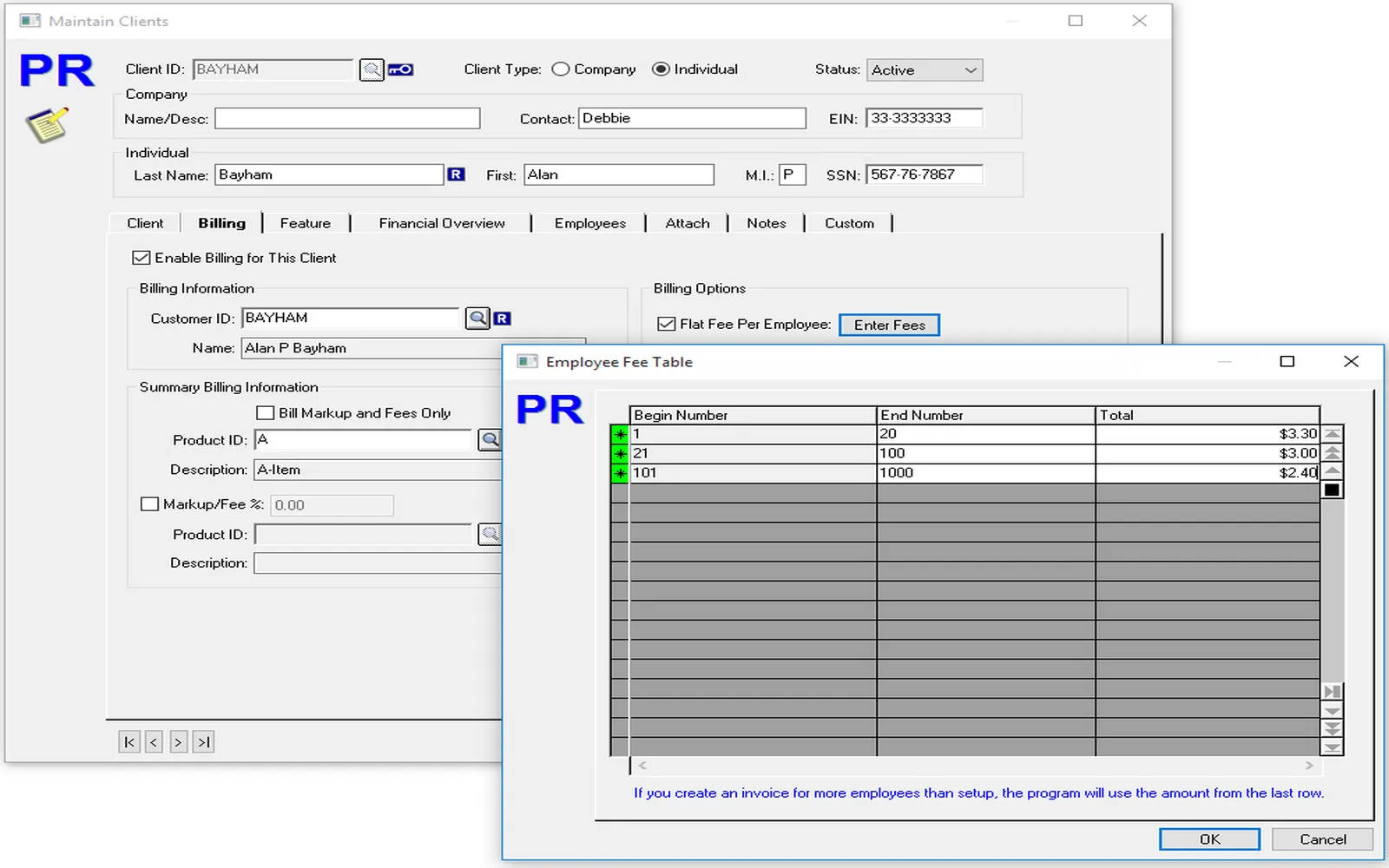

2. Pricing Structure

Understanding the pricing structure of payroll services is essential. Some providers charge a flat monthly fee, while others may charge per employee or transaction. Be sure to clarify any additional fees for services such as tax filing or year-end reporting to avoid surprises.

3. Customer Support

Reliable customer support is crucial when dealing with payroll issues. Look for providers that offer responsive customer service, ideally with multiple contact options (phone, email, chat) and extended hours of availability.

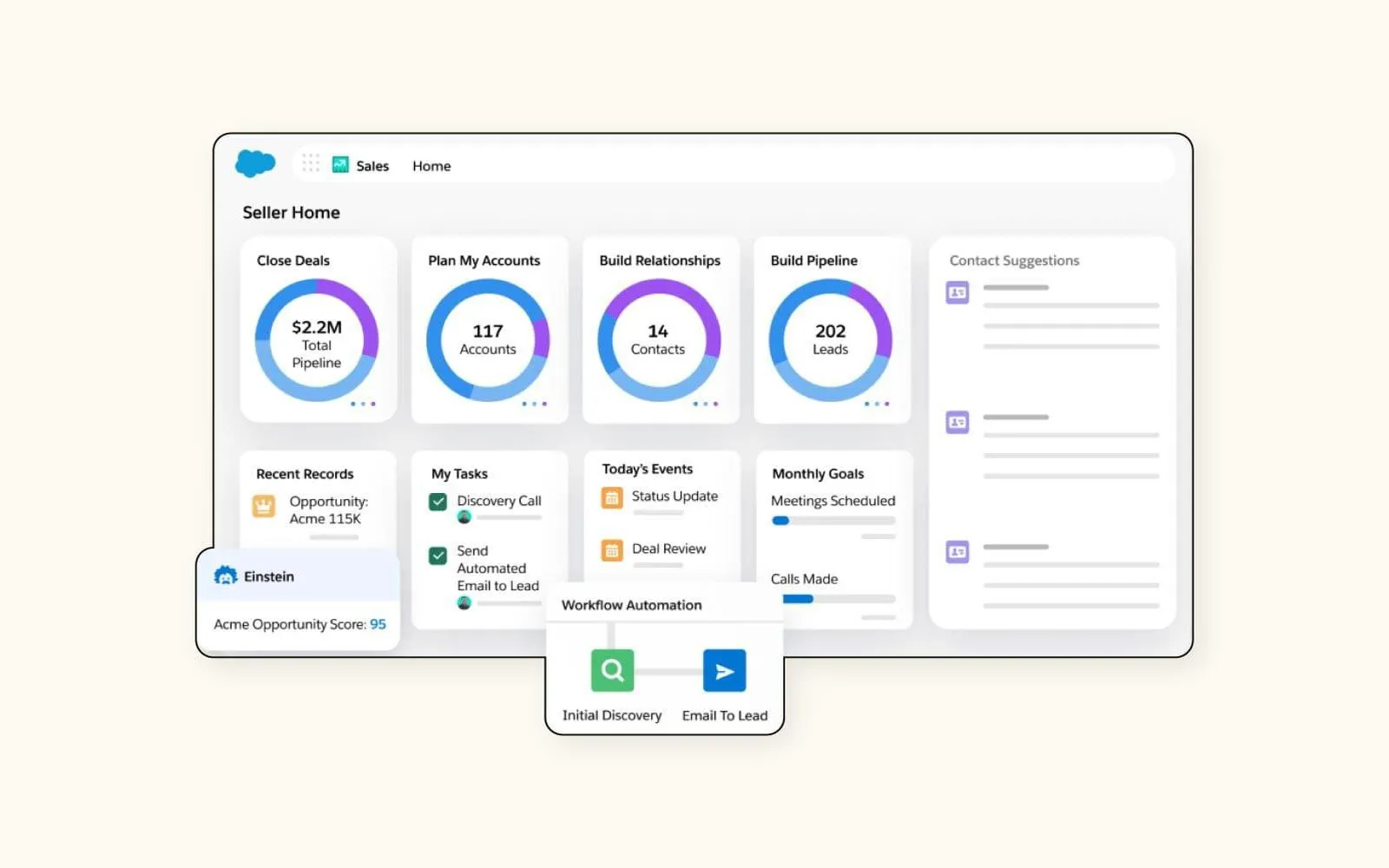

4. User-Friendly Technology

Payroll software should be easy to use and navigate. Look for providers that offer intuitive platforms with features such as employee self-service portals, automated calculations, and mobile access. A user-friendly interface can save time and reduce the likelihood of errors.

5. Security Measures

Payroll data is sensitive and must be protected from unauthorized access. Ensure that the payroll service provider has robust security measures in place, including data encryption, secure servers, and regular data backups to protect your information.

Integrating Payroll with Other Business Systems

For small businesses, integrating payroll services with other business systems can streamline operations and improve efficiency. Consider how your payroll service can work alongside your accounting software, HR systems, and time-tracking tools.

1. Accounting Software Integration

Integrating payroll with accounting software can reduce data entry and minimize errors. Many payroll providers offer integrations with popular accounting platforms, allowing for seamless data transfer between systems. This ensures that financial records are accurate and up-to-date.

2. HR Management Systems

Integrating payroll with HR management systems can enhance employee management and streamline processes such as onboarding, performance tracking, and benefits administration. This integration helps ensure that payroll calculations account for any changes in employee status, such as promotions or terminations.

3. Time and Attendance Tracking

Accurate time tracking is essential for payroll processing. Integrating payroll services with time and attendance tracking tools can automate data collection and ensure that employees are paid accurately for their hours worked. This integration reduces the potential for errors and provides a clear record of employee hours.

Common Payroll Challenges and How to Overcome Them

While payroll services can simplify the payment process, small businesses may still face challenges. Here are some common payroll challenges and strategies to overcome them:

1. Staying Compliant with Tax Laws

Tax laws can be complex and subject to change. To overcome compliance challenges, consider using a payroll service provider that specializes in tax compliance. They can help ensure that your business meets all federal, state, and local tax obligations.

2. Managing Employee Classifications

Misclassifying employees can lead to significant legal issues and financial penalties. To avoid this challenge, ensure that you understand the differences between employees and independent contractors. Consult with a payroll expert or legal advisor to ensure proper classification.

3. Handling Payroll for Remote Employees

With the rise of remote work, managing payroll for geographically dispersed employees can be challenging. Ensure that your payroll service can accommodate remote employees, including applicable state tax regulations. Consider using time tracking tools to manage hours worked by remote staff effectively.

4. Addressing Payroll Errors

Even with the best payroll systems in place, errors can occur. Establish a process for reviewing and correcting payroll discrepancies promptly. Communicate openly with employees about any issues and ensure that they are resolved quickly to maintain trust and satisfaction.

Conclusion

Payroll services can significantly ease the burden of managing employee compensation for small business owners. By understanding the benefits of payroll outsourcing, choosing the right service provider, and integrating payroll with other business systems, small businesses can streamline their operations and reduce the risk of costly errors. While challenges may still arise, with the right tools and strategies in place, payroll management can be made easy, allowing business owners to focus on what they do best: running and growing their businesses.

Explore

Payroll Software: Streamlining Payroll Management for Businesses

Streamline Your Small Business: The Ultimate Guide to Easy CRM Solutions

Top Payroll Software Solutions: Streamline Your Business's Payroll Process in 2023

Best Payroll Providers for Small Business Efficiency

Bookkeeping Services for Small Businesses: A Comprehensive Guide

Best Payroll Companies to Simplify Your Business Operations

Best Payroll Billing Software to Optimize Your Business

Business Cell Phone Service: A Comprehensive Guide for Small and Large Businesses