What Is a Mortgage Lender and How to Choose the Right One

A mortgage lender is a financial institution or company that provides loans to help individuals buy, refinance, or build a home. Understanding how lenders work and knowing how to choose the right one can save you time, stress, and money during your home buying journey.

What Does a Mortgage Lender Do?

Mortgage lenders provide the funds you need to purchase real estate and establish the terms of repayment—such as interest rate, loan term, and fees. They assess your financial profile to determine your eligibility, then underwrite and fund the loan.

Types of Mortgage Lenders

Here are the main types of mortgage lenders:

🏦 Banks and Credit Unions

- Examples: Wells Fargo, Chase, Bank of America

- Benefits: Full-service institutions, in-person assistance

- Drawback: May have stricter credit requirements

🏠 Mortgage Brokers

- Act as intermediaries between you and multiple lenders

- Can help you find competitive rates from various sources

🌐 Online Mortgage Lenders

- Examples: Rocket Mortgage, Better.com

- Benefits: Fast digital applications, transparent tools

- Drawback: Limited or no in-person service

✅ Direct Lenders

- Lend their own money and manage the entire process

- Examples: LoanDepot, Guaranteed Rate

Popular Mortgage Loan Types

- Conventional Loans – Not backed by the government; best for borrowers with strong credit

- FHA Loans – Backed by the Federal Housing Administration; allows lower down payments

- VA Loans – For veterans and service members; no down payment required

- Jumbo Loans – For amounts above conforming loan limits

- USDA Loans – For rural homebuyers; may offer zero down payment

How to Choose the Right Mortgage Lender

When shopping for a lender, consider the following:

🔎 1. Compare Interest Rates

Even a 0.25% rate difference can cost thousands over the life of the loan.

💬 2. Review Customer Service

Look for lenders with strong reviews and accessible support.

📝 3. Understand Loan Terms

Read the fine print, including APR, closing costs, and fees.

📱 4. Evaluate Application Process

Choose a lender with a process that fits your comfort level—online or in-person.

💰 5. Ask About Preapproval

A preapproval letter from a lender strengthens your offer when buying a home.

Top Mortgage Lenders to Consider

| Lender | Best For | Loan Types |

|---|---|---|

| Rocket Mortgage | Online applications | Conventional, FHA, VA, Jumbo |

| Wells Fargo | In-person support | Fixed, ARM, Jumbo, FHA, VA |

| Veterans United | VA loan borrowers | VA Loans only |

| LoanDepot | Fast refinancing | Fixed, ARM, FHA, VA, Jumbo |

| Better Mortgage | Low fees, no commissions | Conventional, Jumbo, FHA |

Final Thoughts

Your mortgage lender plays a major role in your home buying experience. Take time to compare options, get multiple quotes, and ask questions. A good lender not only offers competitive rates but also provides clear communication and support throughout the process.

Explore

Unlocking Homeownership: Your Guide to Choosing the Right Mortgage Lender

Why You Need a Personal Injury Lawyer & How to Choose One

Car Insurance: What You Need to Know and How to Choose the Right Coverage

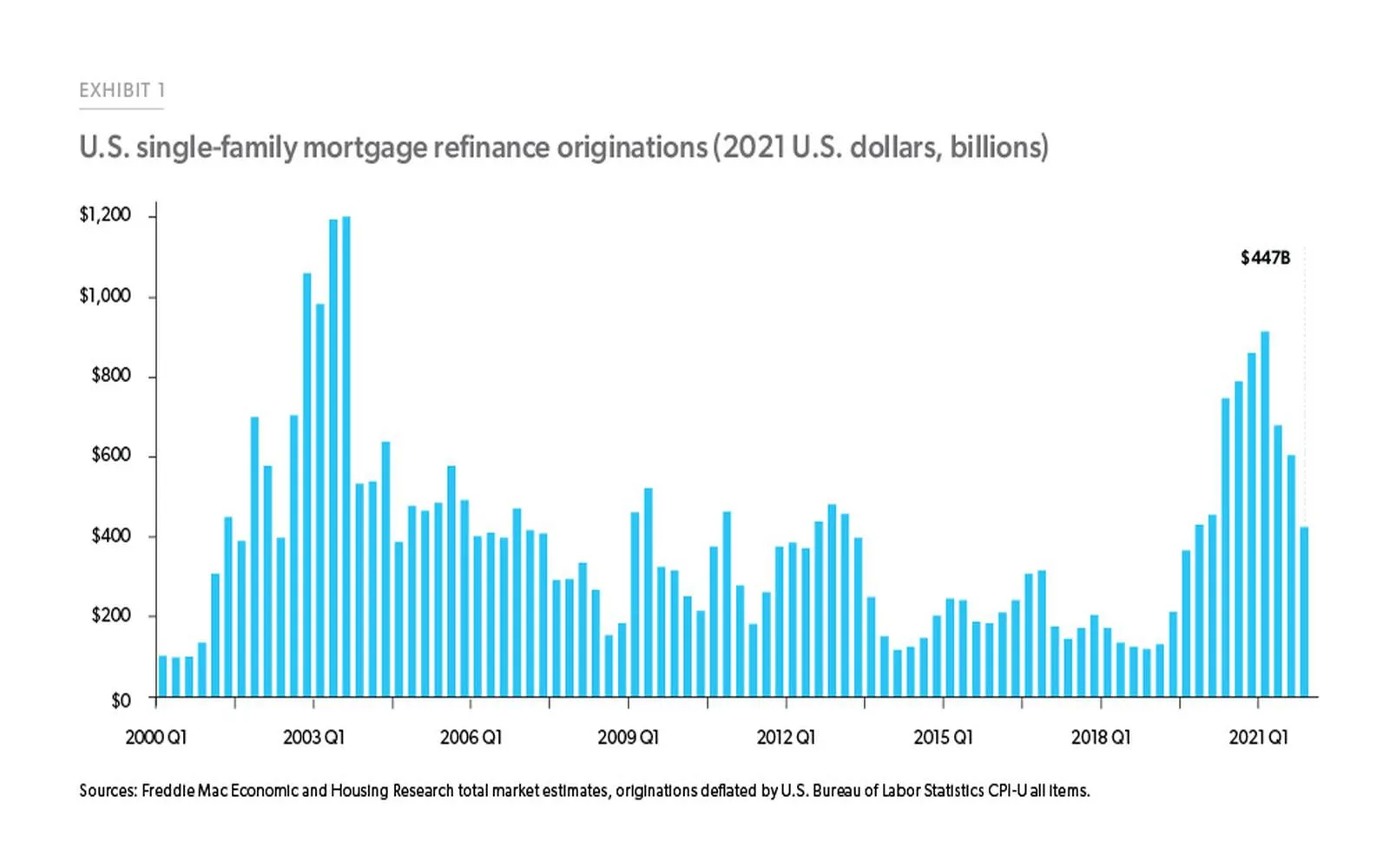

Mortgage Refinance Rates: Unlock the Best Savings Today

How to Choose the Best Plumbing Contractor for Your Home

How to Choose the Best Water Filter for Your Home

How to Sell Your House: Finding the Right Realtor and Alternatives

Maximizing Your ROI: Choosing the Right Google Ads Management Company