Best Personal Loan Offers: Compare Rates & Benefits

Understanding Personal Loans

Personal loans are unsecured loans that provide individuals with a lump sum of money, which they can use for various purposes, such as consolidating debt, financing a large purchase, or covering unexpected expenses. Unlike mortgages or auto loans, personal loans do not require collateral, making them an attractive option for many borrowers. However, the interest rates, terms, and fees associated with personal loans can vary significantly from one lender to another. Thus, it’s crucial to compare rates and benefits before making a decision.

The Importance of Comparing Personal Loan Offers

When considering a personal loan, comparing offers from multiple lenders is essential. Not only can this help you find the best interest rate, but it can also provide insights into the loan terms and additional benefits that different lenders might offer. A lower interest rate can save you money over the life of the loan, while favorable terms can make repayment easier. Understanding these factors will empower you to make an informed decision that aligns with your financial goals.

Factors to Consider When Comparing Personal Loan Offers

When comparing personal loan offers, several factors should be taken into account:

Top Personal Loan Offers to Consider

Here are some of the best personal loan offers currently available in the market, along with their respective rates and benefits:

1. SoFi

SoFi is known for its competitive interest rates and flexible loan terms. With interest rates ranging from 5.99% to 16.99% APR, SoFi offers loans between $5,000 and $100,000. There are no origination fees, and borrowers can choose repayment terms of 3, 5, or 7 years. One of the standout benefits of SoFi is its unemployment protection program, which allows borrowers to pause payments if they lose their jobs.

2. Marcus by Goldman Sachs

Marcus offers personal loans with no fees and competitive rates starting at 6.99% APR. Borrowers can choose from loan amounts ranging from $3,500 to $40,000, with repayment terms of 3 to 6 years. One unique feature of Marcus is its ability to allow borrowers to customize their payment dates, making it easier to manage monthly payments.

3. Discover Personal Loans

Discover provides personal loans with interest rates ranging from 6.99% to 24.99% APR. The loan amounts range from $2,500 to $35,000, and there are no origination fees. Discover also offers a unique benefit: if you pay off your loan early, you won’t incur any prepayment penalties. Additionally, Discover's customer service is highly rated, providing borrowers with support throughout the loan process.

4. LightStream

LightStream, a division of SunTrust Bank, offers some of the most competitive rates in the industry, starting as low as 3.99% APR for those with excellent credit. Loan amounts range from $5,000 to $100,000, with terms from 2 to 12 years. One standout feature of LightStream is its "Rate Beat" program, which promises to beat any competitor’s rate by 0.10% if you find a better offer.

5. Upgrade

Upgrade offers personal loans with rates starting at 7.99% APR. Borrowers can access loans from $1,000 to $50,000, and repayment terms vary from 3 to 5 years. Upgrade also allows borrowers to access free credit monitoring tools, helping them to manage their credit scores effectively. Additionally, Upgrade offers a unique feature called "Credit Health," which provides insights into improving your credit score.

6. Avant

Avant specializes in providing personal loans to borrowers with less-than-perfect credit. Interest rates range from 9.95% to 35.99% APR, with loan amounts from $2,000 to $35,000. Avant offers a user-friendly online application process and quick funding, often within the same day. While rates may be higher than other lenders, Avant's flexibility makes it a good option for borrowers with lower credit scores.

7. Payoff

Payoff focuses specifically on helping borrowers pay off credit card debt. Their personal loans come with rates between 5.99% and 24.99% APR, with amounts ranging from $5,000 to $40,000. Payoff does not charge any fees, and they provide access to financial wellness resources to help borrowers manage their money more effectively. Their unique approach makes them an attractive option for those looking to consolidate debt.

Understanding Credit Scores and Their Impact on Personal Loan Offers

Your credit score plays a crucial role in determining the interest rates and terms you will receive when applying for a personal loan. Lenders typically categorize borrowers into different credit tiers, ranging from excellent to poor. A higher credit score can qualify you for lower interest rates, while a lower score may result in higher rates or even denial of your application. Understanding your credit score and taking steps to improve it can significantly enhance your borrowing options.

How to Improve Your Credit Score Before Applying for a Loan

If you’re looking to secure a better personal loan offer, consider taking the following steps to improve your credit score:

Conclusion

Finding the best personal loan offer requires careful consideration and comparison of various lenders. By understanding the factors that influence loan rates and terms, you can make an informed decision that suits your financial situation. Whether you are looking to consolidate debt, fund a large purchase, or cover unexpected expenses, there are numerous options available. Always take the time to shop around, read reviews, and evaluate the benefits each lender offers. With the right information and a proactive approach, you can secure a personal loan that aligns with your needs and helps you achieve your financial goals.

Explore

Top Personal Loan Platforms: Your Ultimate Guide to Finding the Best Rates and Terms

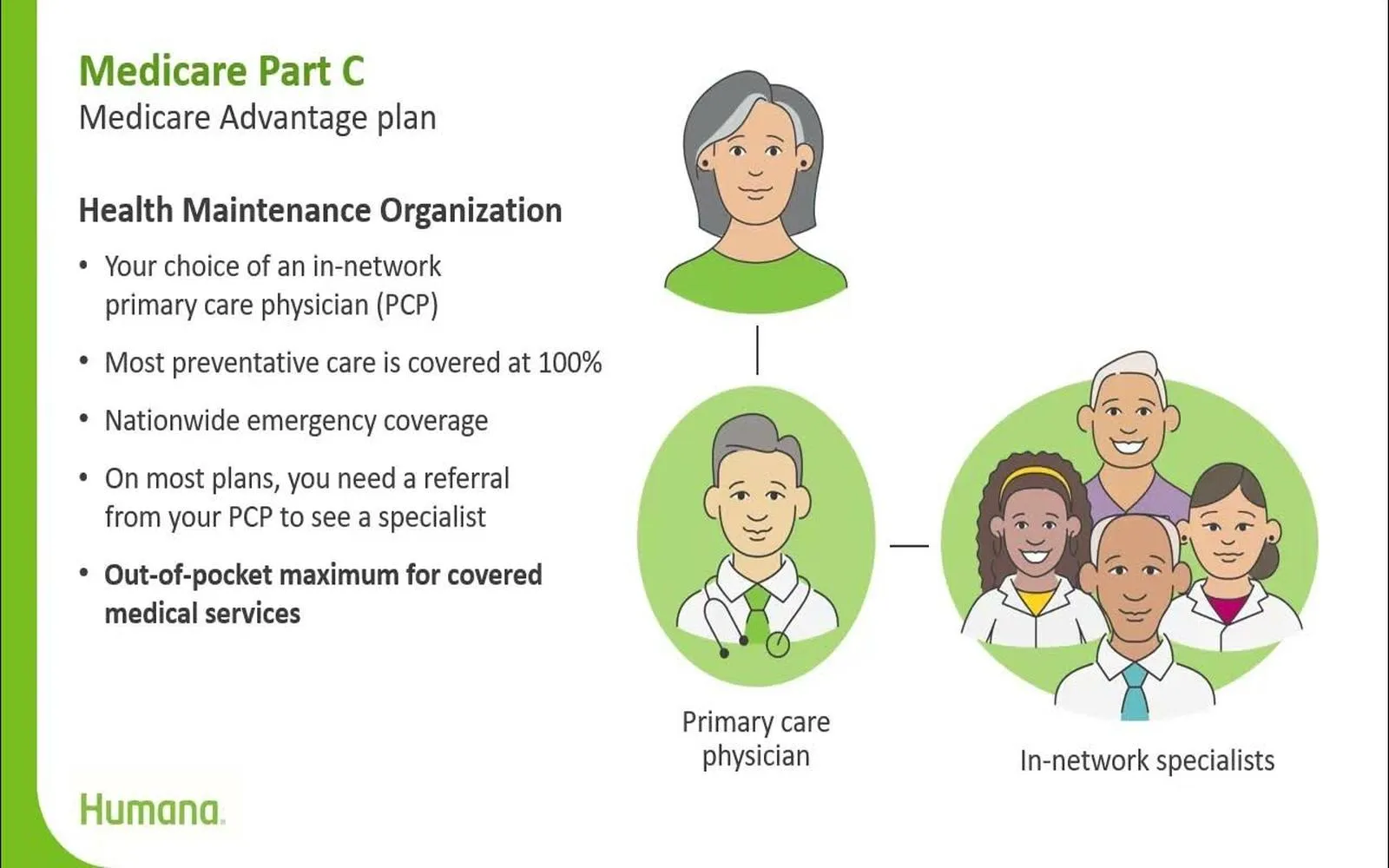

Humana Medicare Plans: Compare Coverage & Benefits

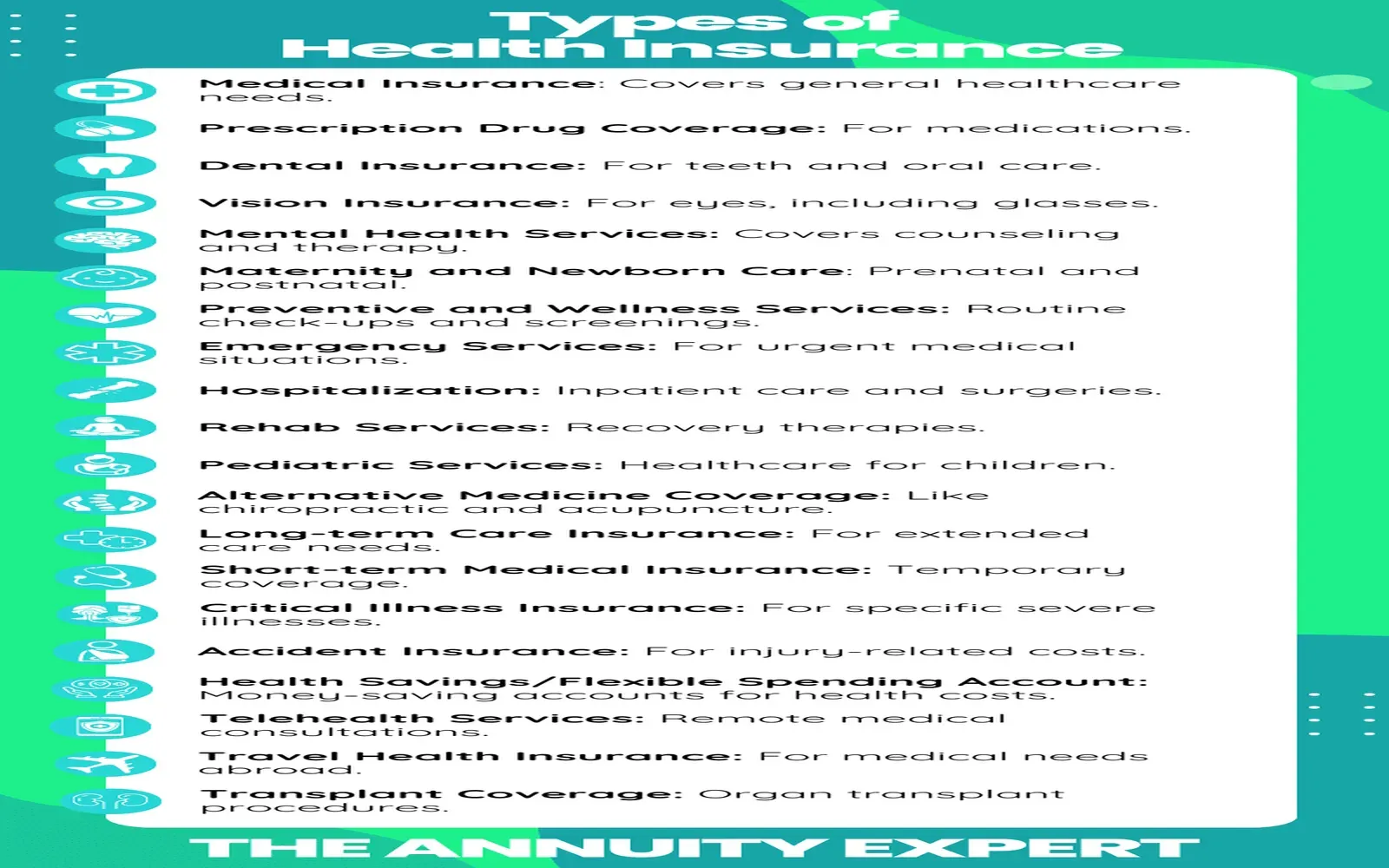

Private Health Insurance: Compare Plans, Costs & Benefits

Senior Cell Phone Deals: Best Plans & Offers for Savings

Unbeatable Travel Deals: Save Big with Travelocity's Latest Offers!

Finding the Right Personal Loan Site: What to Know Before You Borrow

Unlock Your Adventure: How to Easily Compare Travel Insurance Quotes Online

Compare AARP Insurance Quotes for Affordable Coverage