Finding the Right Personal Loan Site: What to Know Before You Borrow

A personal loan site is your gateway to borrowing money online, often quickly and with flexible terms. Whether you're consolidating debt, covering medical expenses, or making a big purchase, choosing the right platform can make the difference between saving money or paying hidden fees.

What Is a Personal Loan Site?

A personal loan site is a website or platform that lets you:

- Apply for a personal loan online

- Compare rates from multiple lenders

- Check your eligibility without affecting your credit score (via a soft credit pull)

- Receive funds quickly, often within 1–3 business days

Some are marketplace lenders (like LendingTree or NerdWallet), while others are direct lenders (like SoFi or Upgrade).

Key Features to Look For

When comparing personal loan sites, focus on:

🔹 Prequalification Tools

Look for sites that allow you to check potential rates without impacting your credit.

🔹 Transparent Fees

The best sites clearly list any origination, late, or prepayment fees.

🔹 Range of Loan Amounts

Loan options typically range from $1,000 to $100,000.

🔹 Flexible Repayment Terms

Terms often range from 12 to 84 months, depending on the lender and your credit profile.

Top Personal Loan Sites to Consider

| Platform | Best For | Loan Amounts | Highlights |

|---|---|---|---|

| SoFi | High-credit borrowers | Up to $100,000 | No fees, member benefits |

| LendingClub | Debt consolidation | Up to $40,000 | Joint loans allowed |

| Upstart | Limited credit history | $1,000–$50,000 | AI-based approval system |

| LightStream | Large loans, fast funding | Up to $100,000 | Same-day funding, no fees |

| Avant | Fair-credit borrowers | Up to $35,000 | Fast approval |

Benefits of Using a Personal Loan Site

✔️ Quick application process

✔️ Multiple offers from top lenders

✔️ No collateral needed (for unsecured loans)

✔️ Convenient document upload and tracking

✔️ Better rates for strong credit

How to Apply Through a Personal Loan Site

- Check Your Credit Score – Know where you stand before applying.

- Use Prequalification Tools – Estimate your rates without a credit hit.

- Compare Offers – Review APRs, fees, and repayment terms.

- Choose the Best Offer – Select the lender that meets your needs.

- Submit Full Application – Upload necessary documents.

- Get Funded – In many cases, within 1–3 days.

Conclusion

A personal loan site can help you access competitive rates, compare multiple lenders, and find financing fast—all with minimal hassle. By knowing what to look for and how to apply, you’ll be better equipped to borrow smartly and confidently.

Explore

Top Personal Loan Platforms: Your Ultimate Guide to Finding the Best Rates and Terms

Car Insurance: What You Need to Know and How to Choose the Right Coverage

Best Personal Loan Offers: Compare Rates & Benefits

Comprehensive Guide to Student Loan Assistance Options: Find the Right Help for Your Education Debt

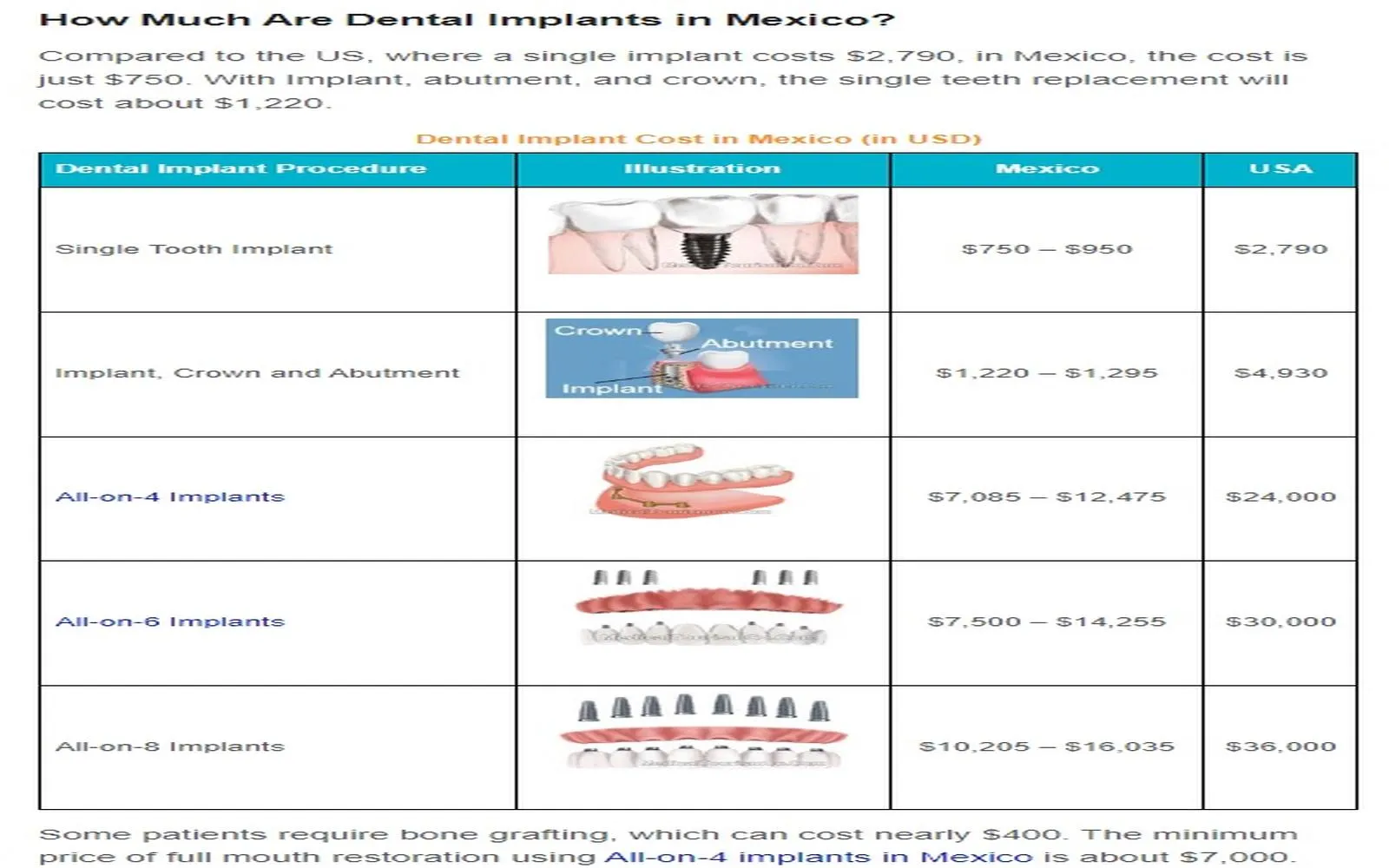

Comprehensive Guide to Dental Insurance with Implant Coverage: What You Need to Know

Everything You Need to Know About Window Replacement: Costs, Options, and Top Installers

How to Sell Your House: Finding the Right Realtor and Alternatives

Finding the Right Window Installers for Your Home