High-Yield Savings Accounts: Earn More on Your Money

A high-yield savings account (HYSA) is a smart financial tool for anyone looking to grow their savings faster than with a traditional bank account. With significantly higher interest rates and the same safety protections, these accounts have become increasingly popular among savers and investors alike.

What Is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers a much higher annual percentage yield (APY) compared to standard accounts. While traditional savings accounts might offer around 0.01% APY, many HYSAs offer 3% to 5% APY—or even more—helping your money grow faster with minimal effort.

Key Features

✅ Higher Interest Rates

The biggest advantage is the competitive APY. Your money earns more just by sitting in the account.

✅ FDIC or NCUA Insurance

Most HYSAs are insured up to $250,000, meaning your money is protected even if the bank fails.

✅ Low to No Fees

Top HYSA providers offer no monthly fees, no minimum balance requirements, and low maintenance costs.

✅ Easy Access

These accounts are usually available online, with 24/7 access and fast transfers to checking accounts.

Best Uses for a High-Yield Savings Account

- Emergency Funds

- Short-Term Goals (vacations, car purchases, etc.)

- Saving for Taxes or Insurance Premiums

- A Safe Place to Store Extra Cash

Top High-Yield Savings Account Providers (as of 2025)

| Bank/Platform | APY (Approx.) | Monthly Fees | Minimum Balance |

|---|---|---|---|

| Ally Bank | 4.35% | $0 | $0 |

| Discover Bank | 4.25% | $0 | $0 |

| Marcus by Goldman Sachs | 4.40% | $0 | $0 |

| SoFi | 4.60% (w/ direct deposit) | $0 | $0 |

| American Express® Bank | 4.30% | $0 | $0 |

| Capital One 360 | 4.35% | $0 | $0 |

Rates are subject to change and may vary based on market conditions or deposit requirements.

Pros and Cons

✅ Pros:

- High interest with zero risk

- Accessible and easy to use

- No hidden fees

- Encourages savings discipline

⚠️ Cons:

- Limited transactions per month (due to federal rules)

- Rates may fluctuate

- Doesn’t replace long-term investment accounts

How to Choose the Right HYSA

When picking a high-yield savings account, consider:

- Interest Rate (APY)

- Fees and Penalties

- Accessibility and Mobile App Quality

- Customer Support

- Transfer Speed and Integration with Checking Accounts

Final Thoughts

If you're parking your money in a regular savings account earning next to nothing, it’s time to make a switch. High-yield savings accounts offer an easy, secure way to increase your earnings with minimal effort. They’re ideal for both conservative savers and savvy investors looking for a reliable cash reserve.

Explore

Unlocking Financial Freedom: The Benefits of Online Savings Accounts

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Top 10 Free Online Business Bank Accounts for Entrepreneurs in 2023

Certified Used Toyota RAV4: Quality, Reliability & Smart Savings

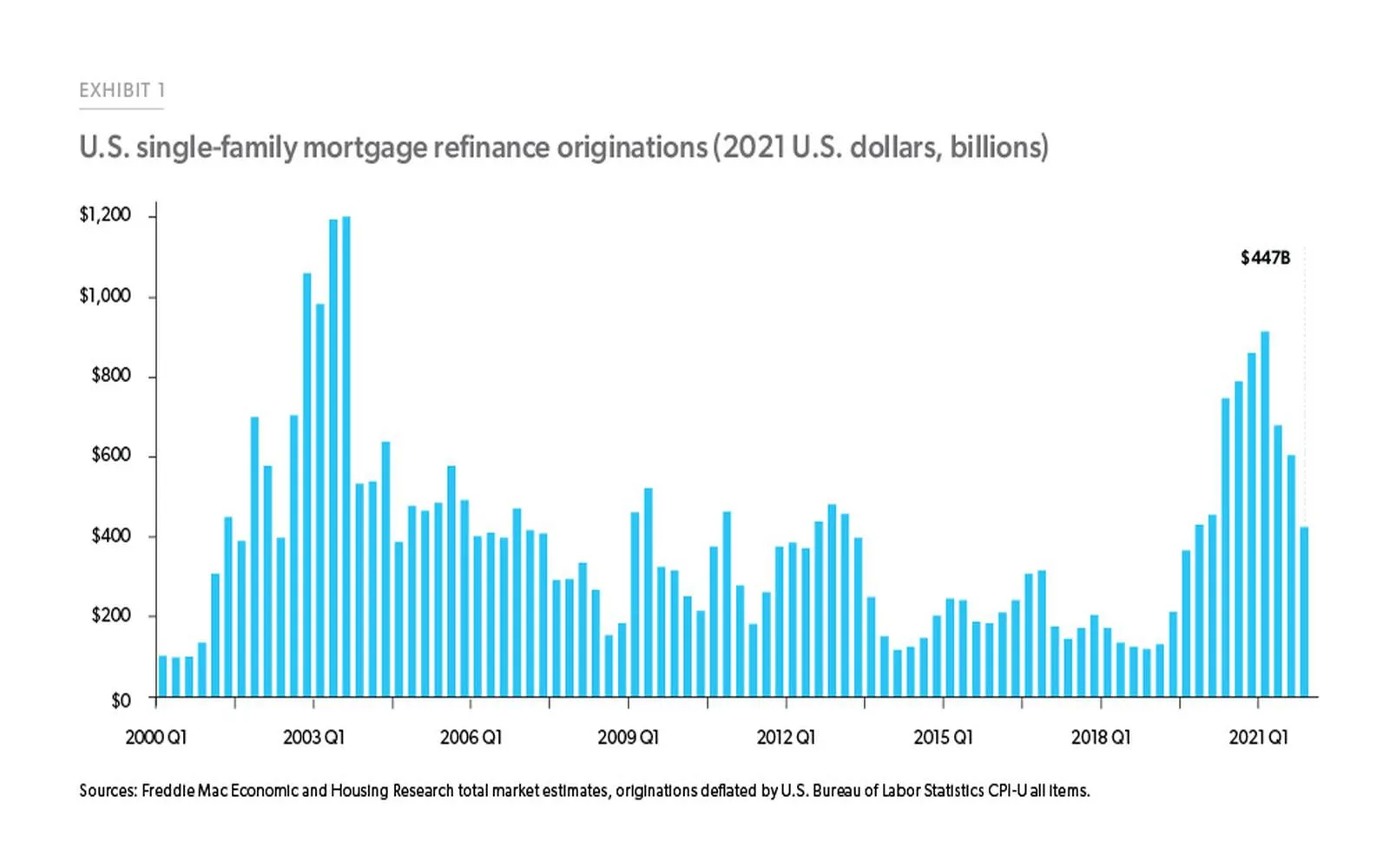

Mortgage Refinance Rates: Unlock the Best Savings Today

Senior Cell Phone Deals: Best Plans & Offers for Savings

Fortifying Your Digital Fortress: Essential Security Tips to Protect Your Smartphone

Unlock Your YouTube Potential: Proven Strategies to Skyrocket Your Video Views!