Unlocking Financial Freedom: The Benefits of Online Savings Accounts

Finding the best savings account for teens is essential for fostering financial literacy and responsible money management from an early age. High-interest savings accounts designed for minors not only provide a secure place to stash savings but also offer competitive interest rates that can significantly boost a young saver’s funds over time. Opening an online savings account for a child allows parents to instill good habits while enjoying the convenience of digital banking. With various options available, it's crucial to compare the best savings interest rates and account features to ensure your teen's financial journey starts on the right foot.

Introduction to Savings Accounts for Teens

As financial literacy becomes increasingly important in today’s world, teaching teens about saving money is a vital life skill. One of the best ways to help them learn about managing finances is by opening a savings account tailored specifically for their needs. In this article, we will explore the best savings accounts for teens, focusing on high-interest options, online accounts, and other valuable features that can help young savers grow their money effectively.

Why Choose a Savings Account for Teens?

Opening a savings account for teens has numerous benefits. First and foremost, it encourages the habit of saving from an early age, teaching them the importance of setting financial goals. Additionally, many savings accounts for minors offer educational resources, enabling parents and guardians to engage in discussions about budgeting and saving. Most importantly, these accounts often come with higher interest rates compared to standard checking accounts, allowing teens to watch their savings grow over time.

High Interest Savings Accounts for Teens

High-interest savings accounts are particularly appealing for young savers. These accounts typically offer better interest rates than traditional savings accounts, helping teens maximize their savings. When researching high-interest savings accounts, it’s essential to compare the annual percentage yield (APY) across various institutions. Some banks and credit unions even offer promotional rates for new accounts, which can provide an excellent opportunity for teens to start saving more effectively.

Opening a Savings Account for a Child

When considering a savings account for a child, parents should look for accounts that allow joint ownership, ensuring that they can oversee transactions while teaching their children about managing money. Many banks and credit unions have specific accounts designed for children and teens, with features that include no monthly fees, low minimum balance requirements, and educational materials. These accounts are often structured to transition into a standard savings account once the child reaches adulthood, making the process seamless.

Best Interest Savings Accounts for Teens

Some of the best interest savings accounts for teens are those that not only offer competitive interest rates but also come with additional perks. For example, some accounts may provide online banking features, mobile apps, and educational tools. Additionally, accounts that reward good saving habits with bonus interest or cash incentives can motivate teens to save more. When evaluating potential accounts, look for institutions that prioritize customer service and have positive reviews from existing customers.

Best Savings Interest Rates

Finding the best savings interest rates often requires a bit of research. Interest rates can vary widely between banks, credit unions, and online institutions. Online banks tend to offer higher rates due to lower overhead costs, making them a great option for teens. When comparing rates, be sure to consider any fees associated with the account, as these can eat into the interest earned. Websites that aggregate bank offers can help simplify this process and ensure you’re getting the best deal.

Opening an Online Savings Account

Opening an online savings account can be a convenient option for teens and their parents. Online banks typically offer higher interest rates and lower fees than traditional banks. The application process is usually straightforward and can be completed in just a few minutes. Parents should ensure that the online bank they choose is FDIC-insured, which protects deposits up to $250,000. Additionally, online banks often provide user-friendly mobile apps that make it easy for teens to manage their accounts and track their savings goals.

Online Savings Accounts for Minors

Many online banks offer savings accounts specifically designed for minors. These accounts typically require parental consent to open, allowing parents to maintain oversight while teaching their children about saving. Features of online savings accounts for minors often include low or no fees, competitive interest rates, and educational resources. Some accounts also offer tools for setting up savings goals, which can help teens visualize their progress and stay motivated.

Best Savings Account Interest Rate Options

When looking for the best savings account interest rate options, it’s crucial to consider both the APY and the account terms. Some accounts may offer promotional rates that revert to lower rates after a specified period, while others may have tiered interest rates based on the account balance. Be sure to read the fine print and understand the terms before opening an account. It’s also wise to periodically review interest rates, as financial institutions may adjust their offerings based on market conditions.

Factors to Consider When Choosing a Savings Account for Teens

Several factors should be taken into account when selecting the right savings account for teens. These include:

- Interest Rates: Look for accounts with competitive rates to ensure maximum growth for savings.

- Fees: Avoid accounts with high monthly fees or maintenance costs that can diminish savings.

- Accessibility: Choose an account that offers easy online access and a user-friendly app for managing funds.

- Parental Controls: Consider accounts that allow parents to monitor transactions and set restrictions as necessary.

- Educational Resources: Look for banks that provide tools and resources to help teach teens about financial literacy.

Conclusion

Opening a savings account for teens is an excellent way to instill the importance of saving and financial responsibility. With numerous options available, including high-interest savings accounts and online accounts, parents can find the perfect fit for their children’s needs. By considering factors such as interest rates, fees, and educational resources, families can make informed decisions that will benefit young savers in the long term. Ultimately, the right savings account can set the stage for a lifetime of healthy financial habits, empowering teens to achieve their goals and secure their financial futures.

Explore

Unlocking Financial Freedom: Your Guide to Tax Debt Relief Solutions

Unlocking Financial Freedom: The Best Credit Cards of 2025 for Every Lifestyle

High-Yield Savings Accounts: Earn More on Your Money

Unlocking Potential: The Benefits of Earning Your Early Childhood Degree Online

Top 10 Free Online Business Bank Accounts for Entrepreneurs in 2023

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Certified Used Toyota RAV4: Quality, Reliability & Smart Savings

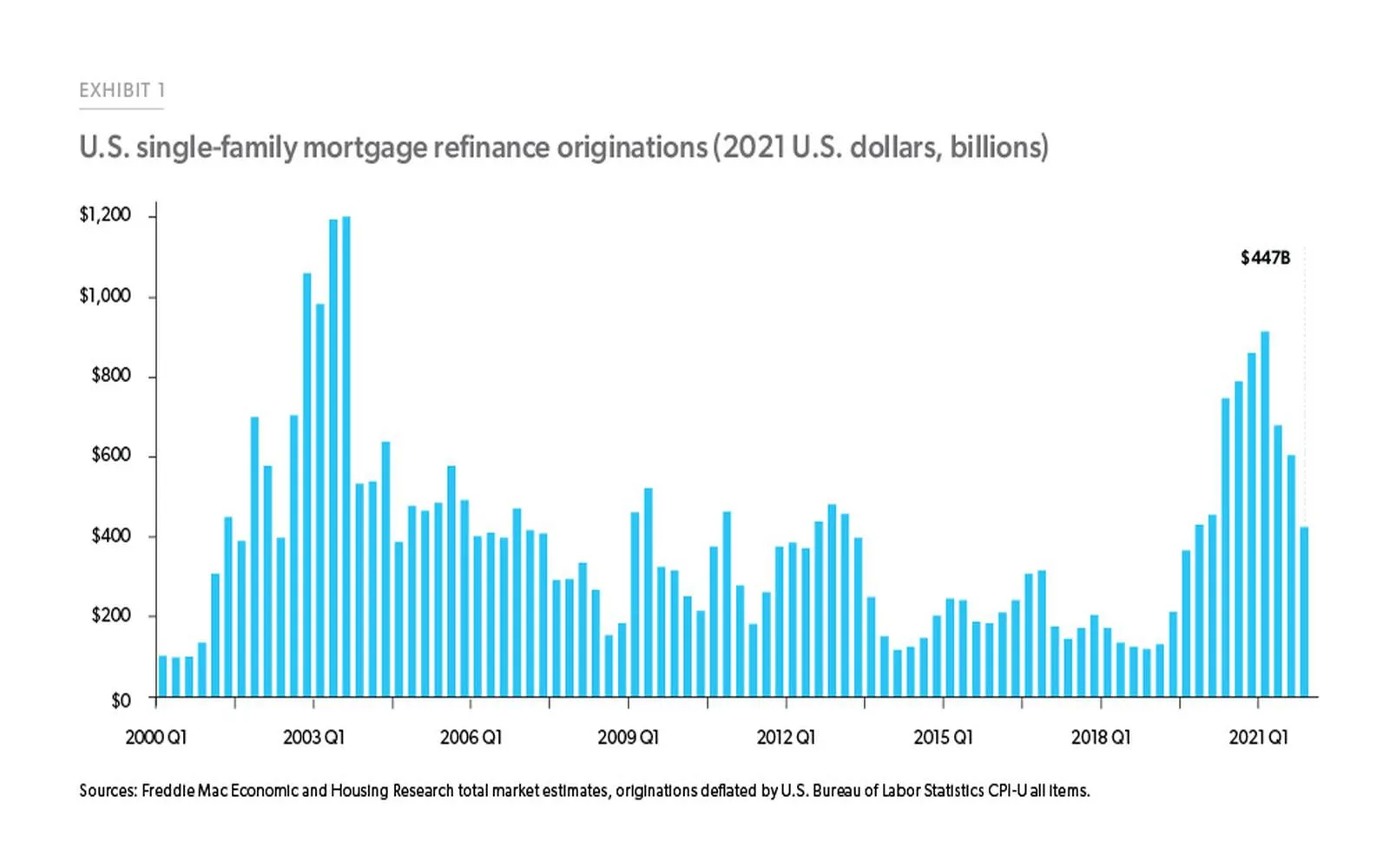

Mortgage Refinance Rates: Unlock the Best Savings Today